What details required to tally integration with iBill?

How to configure Tally ERP 9 and Tally Prime on Factech and iSocietyManager Billing

in iBill, you can export XML containing Tally compatible journal entries which can be exported directly in your Tally Application. This is 3 Steps process that you need to do one time. only.

1. Map Tariff with Tally Ledger Name

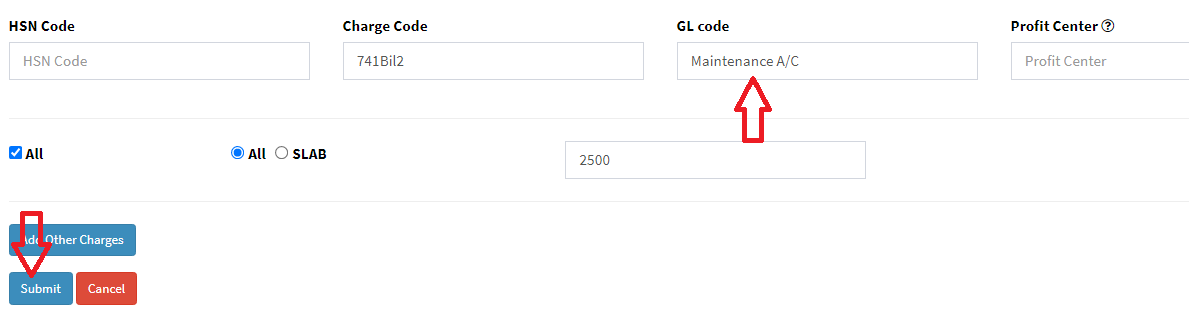

In order to configure tally iBill, you need to update the ledger under tariff with respect to the ledger or account defined in the Tally.

After login with a role having tariff update permission, you can update tariff or charge as per requirements.

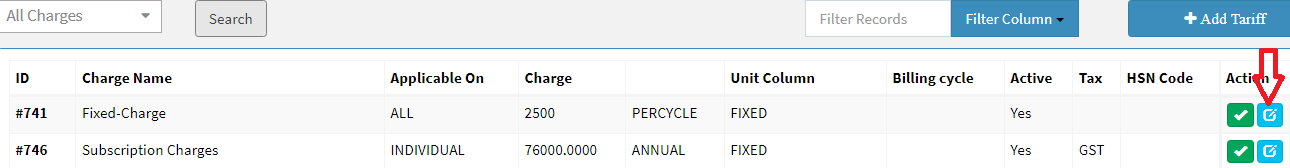

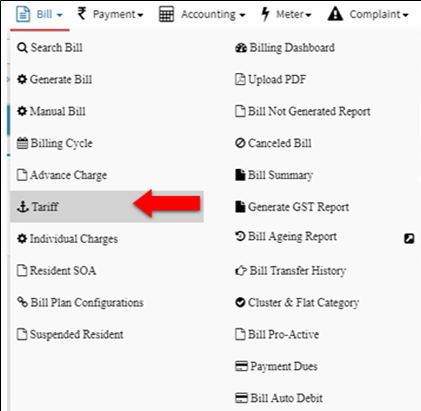

- Step1: Go to main menu (Bill), Select “Tariff” option from drop down menu

- Step2: You can update any existing charge as per your needs on click of “Edit” button

- Step3: Enter tally ledger name under GL code and click on the “Submit” button

You can add new charge/tariff in FacTech by using below link

https://factech.co.in/blog/ufaqs/how-to-add-tariff-for-bill-generation/

2. Map Customer with respective Tally Ledger

- Update SAP code in user details with respect to unit ledger or account defined in tally by using below link

How to import units?

3. Share Bank and Other Tally Ledger Details

- Following details need to share with the Factech team over email to configure the tally utility.

| Key | Tally Ledger Name |

| Company Name | FACTECH AUTOMATION SOLUTIONS PRIVATE LIMITED |

| TDS_ACCOUNT | TDS Receivable |

| CASH A/C | Axis Bank (919020029759966) |

| Bank A/C | Axis Bank (919020029759966) |

| CHEQUE | Axis Bank (919020029759966) |

| NEFT | Axis Bank (919020029759966) |

| RTGS | Axis Bank (919020029759966) |

| ONLINE | Axis Bank (919020029759966) |

| OTHER | Axis Bank (919020029759966) |

| CREDIT | Axis Bank (919020029759966) |

| DEBIT | Axis Bank (919020029759966) |

| IGST A/C | IGST@18% |

| SGST A/C | SGST@9%(input) |

| SGST A/C | CGST@9%(input) |

| SGST A/C | SGST@9%(output) |

| SGST A/C | CGST@9%(output) |

Once Factech team configured utility then you can generate a bill and payment XML to post the tally by using the below link

Leave a Reply

You must be logged in to post a comment.